|

GoodRich MAGMA Industrial Technologies Limited

OFFERS

MDF / HDF PRODUCTION LINES

FROM CHINA & EUROPE

IN PLANT CAPACITIES OF

30,000 M3/YEAR, & 50,000 M3/YEAR & 80,000 M3/YEAR

|

A view of MDF Plant | |

Another view of MDF Plant |

Rawmaterial preparation section | |

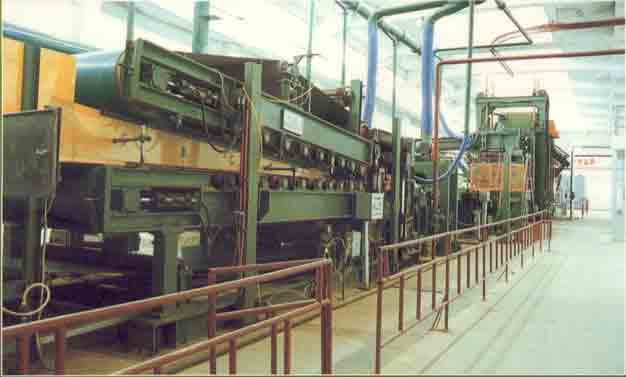

Hot press-loader & unloader |

Energy Plant for MDF | |

Fibre drier for MDF |

Refined fibre for MDF Production | |

Woodwaste ready for MDF production |

| |

MDF fibre arrangement |

|

|

INTRODUCTION -

MDF (Medium Density Fibreboard) is the third generation wood substitute. It exceeds wood, plywood & particle board in terms of quality & applications. We cannot think of modern wood decorations in houses & offices without MDF. It is used for doors, windows, kitchen & office cabinets, drawers, tables & chairs, furnitures, indoor stadiums, auditoriums and entertainment halls.

The worldwide market for MDF is increasing at a faster rate of 12% – 16% per annum. The international market prices of MDF range from $200 – $300 per m3 ($260 – $400 per ton).MDF has the durability, look, texture, richness & feel of seasoned-treated timber. For this reason, MDF is called engineered wood.

Similarly HDF is High Density Fibreboard, which is used for laminated flooring. HDF boards are ideal substitutes for natural timbers & they are widely used in high – strength floorboards as well as furniture decoration. HDF board markets are also growing at a phenomenal rate of 20% every year.

RAW MATERIALS FOR MDF / HDF -

- Firewood from nearby plantations & forests including rubberwood;

- Wood cuttings & trimmings from sawmills;

- Sawdust & furniture industry wastes;

- Round logs of smaller dia (10 cm to 30 cm)from social forestry;

- Bamboo;

- Cotton stalks; &

- Sugarcane bagasse;

There is a scope to set up 25-50 MDF Plants in India over a period of next 5 - 10 years, as against only 2 Plants in operation now.

MDF from wood -

India has 19% of its land by way of forests. A wide variety of trees are grown here, due to the availability of abundant solar energy. Hence a number of MDF Plants can be set up in various parts of the Country to convert these wood wastes into wealth. Since MDF replaces wood & plywood, the pressure on virgin forests are reduced & a new social forestry can be developed near the MDF Factory to meet the future wood requirements.

India has 33 million hectares of wastelands, where the rainfall is above 400 mm per year. Even if 10% of these wastelands are utilized by raising social forestry, it can provide 8.25 million tons of raw material, which is sufficient for more than 100 MDF production lines.

MDF from Bamboo -

India is just next to China in terms of Bamboo cultivation, with 8 million hectares of the forest area (14% of the total forest area of 56 million hectares) under Bamboo. In addition, 2 million hectares of Bamboo is outside the natural forest area. The estimated growing stock of Bamboo in India is about 140 million tons and the yearly availability is 35 million tons. However, only 20 million tons are accessible to transportation every year.

In recent years, the demand for Bamboo from paper & other industries has come down to 7-8 million tons, creating a surplus of 12-13 million tons per year.

Bamboo is available in abundance in the States of Kerala, Maharashtra, Karnataka, Andhra Pradesh, Tamilnadu, Madhya Pradesh, Chattisgarh, Orissa, Jharkhand, West Bengal & in the North Eastern States. Nearly 66% of the Bamboo resources are located in the 7 North Eastern States. Madhya Pradesh has the highest Bamboo forest area of 2.4 million hectares. The other States having major growing stocks of Bamboo are Assam, Manipur, Mizoram, & Arunachal Pradesh. Uttaranchal has also significant Bamboo forests and has plans to bring more areas under Bamboo plantation to develop a sizable resource base.

MDF FROM COTTON STALKS –

India is one of the leading producers of cotton in the world. Every year, about 23 million tons of cotton stalk is generated in the country as agro-waste, which is either burnt in the field or used as fuel by the farmers in their houses.

In India, cotton is grown in 9.22 million hectares, mainly in Gujarat, Maharasthra, Andhra Pradesh, Punjab, Madhya Pradesh, Haryana, Rajasthan, Karnataka & Tamilnadu. During 2005-06 season, the country’s cotton output was at a record of 244 lakh bales of 170 kgs each. With the average cotton productivity of 450 kgs/hectare, the availability of Cotton stalks is estimated as 2.50 tons per hectare.

MDF FROM BAGASSE –

There are 450 Sugar factories in India. A 2,500 TCD Sugar Plant generates 1,20,000 tons of bagasse with 50% moisture, on 160 days of working. Much of this bagasse is burnt to fuel the boiler. Of late, the surplus is used for power generation. Some sugar factories sell surplus bagasse to the nearby paper factories.

Bagasse is valuable cellulose, which deserves better value-addition than simple burning. The notional price of bagasse is taken as Rs. 500/- per ton, which may increase to Rs. 1,100/- per ton on co-generation. If the same is converted into MDF, the price realization will be Rs. 16,000/- per ton.

Bagasse contains 30% pith, which is not suitable for making MDF. The same can be used for the Boiler, along with baled sugarcane trash in place of bagasse. It is possible to bale 90,000 tons of trash by a 2,500 TCD Sugar Factory on 180 days of working. With the de-pithed bagasse of 1,05,000 tons (with 50% moisture), an MDF production line of 50,000 m3/year can be run for throughout the year.

Though bagasse has short length fibres, the recent technology enables MDF production from washed & refined bagasse fibre.

GLOBAL CAPACITY SURVEY OF MDF –

Following are the aggregate world capacity of MDF-

|

Region

|

MDF capacities (In million m3)

|

|

2001

|

2002

|

2003

|

2004

|

|

Australia

&

New

Zealand

|

1.69

|

1.73

|

1.73

|

1.73

|

|

China

|

5.42

|

7.02

|

7.36

|

8.66

|

|

South

East Asia

|

2.60

|

2.76

|

2.85

|

3.21

|

|

North

East Asia

|

1.72

|

1.72

|

1.72

|

1.72

|

|

South

America

|

2.06

|

2.97

|

3.22

|

3.58

|

|

Europe

|

11.52

|

11.92

|

12.46

|

13.18

|

|

North

America

|

5.07

|

5.06

|

5.45

|

5.81

|

|

Rest

of the world *

|

0.48

|

0.61

|

0.64

|

0.79

|

|

Total

|

30.56

|

33.79

|

35.43

|

38.68

|

|

* Includes Africa,

Indian sub-continent, Middle East.

|

The global potential demand for panel boards is estimated at 250 million m3 per year and the potential market for MDF alone is 100 million m3.

The gap of 150 million m3 can be diverted to particleboard, plywood & OSB.

|

MDF Production lines worldwide –

|

|

Year – 2004

|

No. of mills

|

Average size of each MDF mill

|

|

Africa

|

4

|

63,000

m3

|

|

Middle

East (Israel)

|

1

|

86,000

m3

|

|

South

America

|

16

|

1,79,000

m3

|

|

Asia

Pacific

|

|

|

|

-

Australia

|

5

|

1,56,000

m3

|

|

-

China *

|

186

|

45,000

m3

|

|

-

India

|

2

|

58,000

m3

|

|

-

Indonesia

|

7

|

75,000

m3

|

|

-

Iran

|

1

|

30,000

m3

|

|

-

Japan

|

4

|

1,60,000

m3

|

|

-

Korea

|

8

|

1,36,000

m3

|

|

-

Malaysia

|

11

|

1,18,000

m3

|

|

-

New Zealand

|

4

|

2,27,000

m3

|

|

-

Sri Lanka

|

1

|

1,00,000

m3

|

|

-

Pakistan

|

2

|

26,000

m3

|

|

-

Thailand

|

7

|

1,25,000

m3

|

|

-

Vietnam

|

1

|

54,000

m3

|

|

-

Europe

|

64

|

1,87,000

m3

|

|

Canada

|

7

|

2,15,000

m3

|

|

Mexico

|

1

|

60,000

m3

|

|

United

States

|

18

|

1,89,000

m3

|

World Total

|

350 mills

|

World 1,10,000 m3

Average

|

|

* The

total no. of MDF Plants in China exceeded 400 during 2004, but the remaining

are small lines of 5,000 – 20,000 m3 capacity.

|

INDIAN MARKET POTENTIAL FOR PARTICLEBOARD –

The Working Paper by FAO estimated the demand for industrial round wood in India (other than fuel wood) as under –

|

Wood raw material requirement in India -

(in

million cubic meters)

|

|

Sector

|

Year 2000

|

Year 2005

|

Year 2010

|

|

Sawnwood

(For

housing, furniture, agri-implements, sports goods, packaging, etc.)

|

47.00

|

50.00

|

54.00

|

|

Pulp

(Paper, newsprint)

|

23.60

|

28.50

|

35.00

|

|

Plywood

|

1.45

|

1.69

|

1.92

|

|

Particleboard

|

0.34

|

0.49

|

0.65

|

|

Fibrewood

(Hardboard)

|

0.22

|

0.32

|

0.41

|

|

MDF

|

0.40

|

0.67

|

0.95

|

|

Total

|

73.01

|

81.67

|

92.93

|

As per FAO, the requirement of sawnwood by 2005 will be around 50 million cubic meters, which is equal to Rs. 60,000 crores in monetary terms. As against this, the availability of sawnwood in India is only 30 million cubic meters & the balance is imported, draining valuable foreign exchange.

Bulk of the industrial round wood in India is utilized by the saw milling industry, consisting of more than 23,000 units. It is estimated that each sawmill will generate 100 – 120 tons of sawdust & wood cuttings per year on an average and make available totally 2.5 million tons of wood wastes, which can provide necessary raw material for more than 50 new MDF Plants in India.

The projected demand for MDF by 2005 is 6,70,000 tons, whereas the combined capacity of 2 Plants operating in India (Delhi & Calcutta) is only 1,17,000 cubic meters (88,000 tons). Some shortage is covered by MDF imports of around 3,00,000 tons.

MDF PRODUCT STANDARDS –

The product standard of MDF made in the Plant offered by ‘Goodrich’ meets ‘China National Standard GB/T 11718.2 - 1999, which is equal to EURO MDF Board (EMB) Standard 1995, the third Edition. For India, it is well above the Indian Standard i.e., IS 12406 – 1998 ‘Specification for Medium Density Fibre Boards for general purposes’.

MDF consists of standard grades from 6 mm to 25 mm & special grades from 2.5 mm to 5 mm. Special grades also include light MDF, moisture resistant MDF, exterior grade MDF, zero formaldehyde MDF & overlaid MDF with melamine coating / veneering. In the MDF market, 70 – 75% are standard grades & 25 - 30% are special grades.

MDF BOARD MAKING PROCESS –

The MDF production line mainly includes chipping, screening, refining, glue preparation, drying, mat forming, pre-pressing, loading & unloading, hot pressing, edge trimming & sanding. The process starts from the wood yard, designed to ensure continuous & un-interrupted supply of woods.

| SCOPE OF SUPPLY – PLANT & MACHINERY OFFERED FOR MDF PROJECTS – |

| 1. | MDF production line complete with more than 100 individual equipments lined up for continuous production, with a capacity of 30,000 m3/year (22,500 tons), 50,000 m3/year (37,500 tons) or 80,000 m3/year (60,000 tons) | - | 1 set |

| 2. | Formaldehyde (optional) & UF Resin Plants including reactors, storage tanks & pipelines | - | 1 set |

| 3. | Short cycle lamination Plant for overlaying melamine coated paper on MDF(Optional) | - | 1 set |

| 4. | Laminate Flooring Line on HDF (Optional) | - | 1 set |

| 5. | Horizontal Impregnation line to coat melamine on the Plain paper | - | 1 set |

| 6. | Energy Plant to supply steam, heated air & heated oil to the MDF&UF Resin Plants | - | 1 set |

| 7. | Electrical control panels, motors, starters & cabling | - | 1 set |

| 8. | Erection, commissioning, trial run & training the staff | - | 1 set |

| 9. | Steam turbine & Super-heated boiler of high capacity, as suitable for Co-generation to supply captive Power of 3 MW for 30,000m3,4.5 MW for 50,000m3 or 6 MW for 80,000m3 MDF line (Optional) | - | 1 set |

COST OF THE PROJECT-

| | | | (Rs.in crores) |

| | 30,000 m3plant | 50,000 m3Plant | 80,000 m3Plant |

| Factory Buildings | 3.00 | 4.50 | 6.00 |

Plant & Machinery including contingencies**

(excluding co-generation)*** | 22.00 | 28.50 | 44.50 |

| Interest during construction period**** | 1.50 | 1.70 | 2.00 |

| Deposits & Preliminary expenses including Turn-key consultancy fees | 1.50 | 1.80 | 2.00 |

| Working capital margin (25%) | 2.00 | 3.50 | 5.50 |

| Total | Rs.30.00 crores | Rs.40.00 crores | Rs.60.00 crores |

Notes:

| * | Land requirement will be 7.50 acres for 30,000 m3 Plant, 10 acres for 50,000 m3 Plant & 15 acres for 80,000 m3 Plant. Built - up area will be 50,000 sq. ft. for 15,000 m3 Plant, 70,000 sq. ft. for 30,000 m3 Plant,1,00,000 sq. ft. for 50,000 m3 Plant &1,10,000 sq.ft. for 80,000 m3 Plant. |

| ** | The cost of imported Plant & machinery is mainly from China, with certain imported items out-sourced by them from Europe. In case all the Plant & machinery are sourced from European suppliers, the minimum Plant capacity will be 1,20,000 m3 / year & the total project will be Rs. 135 crores. In case the customers prefer Refiners from Austria & Sanding lines from Switzerland, the same will cost Rs. 5.00 crores extra for 15,000 m3 line, Rs. 6.00 crores extra for 30,000 m3 line, Rs. 7.00 crores extra for 50,000 m3 line & Rs. 8.00 crores extra for 80,000 m3 line. China has already supplied 400 MDF Plants, which are capable of producing European quality Boards. |

| *** | The incremental cost of Co-generation equipments will be Rs. 3 crores extra for 15,000 m3 line, Rs. 6 crores extra for 30,000 m3 line, Rs. 9 crores extra for 50,000 m3 line & Rs. 12 crores extra for 80,000 m3 line. However, the pay-back period for co-generation project is 3 years. |

| **** | The lead time for setting up the project will be 12 to 18 months. |

| ***** | All these Plants are capable of producing both MDF & HDF. However in HDF, the Plant capacity will be only 80% of MDF. |

MEANS OF FINANCE-

| | 30,000 m3Plant | 50,000 m3Plant | 80,000 m3Plant |

Share capital

- From Promoters &

associates

- From Foreign institutional

investors &

Venture capital companies | 6.00

6.00 | 7.50

7.50 | 11.00

11.00 |

Total | 12.00 | 15.00 | 22.00 |

Term loan from Banks / All

India financial institutions /

Foreign Finance

Corporations | 18.00 | 25.00 | 38.00 |

Total | Rs.30.00 crores | Rs.40.00 crores | Rs.60.00 crores |

COST OF PRODUCTION & PROFITABILITY –

| 1. Average imported prices of Plain MDF for 8 ft. x 4 ft sizes - | USD 225 per m3 |

| Add: Customs duty @ 36.736% | USD 82 per m3 |

| Add: Port handling charges and importers margin | USD 18 per m3 |

| Total cost of imported MDF | USD 325 per m3 |

In Indian rupees (average

conversion rate is 1 USD=Rs.45) | Rs. 14,625/- per m3 |

| Cost per ton (average density is 750 kg/m3 | Rs. 19,500/- per ton |

| Less:Excise duty+ transport @ 22% | Rs. 3,500/- per ton |

| Suggested Ex-factory price | Rs. 16,000/- per ton |

| | Or

Rs. 15,000/- per ton |

| 2. Cost of Production per ton - | 15,000m3/year | 30,000m3/year | 50,000m3/year |

| A. Wood waste / firewood / round logs of Eucalyptus / other plantation timbers or fresh bamboo,cotton stalks or bagasse with average moisture of 40% -1.8 tons @ Rs.1,500/- per ton | Rs.2,700/- | Rs.2,700/- | Rs.2,700/- |

| B. Cost of UF Resin & Chemicals | Rs.2,400/- | Rs.2,300/- | Rs.2,200/- |

| C. Electricity – 450 KWH /400 KWH / 350 KWH @ Rs. 4 per KWH | Rs.1,800/- | Rs.1,600/- | Rs.1,400/- |

| D. Water -2 m3@Rs.100 per m3 | Rs.200/- | Rs.200/- | Rs.200/- |

| E. Thermal Energy-3,000 / 2,800 / 2,500 kgs of steam =750 / 700 / 625 kgs of firewood or sanding & chipping wastes @ Rs. 1.50 per kg | Rs.1,100/- | Rs.1,050/- | Rs.950/- |

| F. Labourers , Staff & Managers - 100/125/150 nos. @ Rs. 1,20,000/- per year each | Rs.550/- | Rs.400/- | Rs.300/- |

| G. Miscellaneous expenses including factory maintenance, administration & sales | Rs.750/- | Rs.750/- | Rs.750/- |

| Total cost per ton | Rs.9,500/- | Rs.9,000/- | Rs.8,500/- |

| 3. Plant capacities | 30,000m3/year | 50,000m3/year | 80,000m3/year |

| 4. Average weight of the board per m3 is 750 kg. Hence the capacity in tons | 22,500 Tons/year | 37,500 Tons/year | 60,000 Tons/year |

| 5. Revenue per year from MDF @ Rs. 16,000/- per ton value - addition by way of Melamine coating of MDF and Laminate flooring of HDF, which is Rs.1.5 crores / Rs. 3 crores / Rs.3 crores per year | Rs.37.50 crores | Rs.63.00 crores | Rs.99.00 crores |

Less: Cost of production @

Rs. 9,500/- per ton /

Rs.9,000/- per ton/Rs.8,500/- per ton | Rs.21.38 crores | Rs.33.75 crores | Rs.51.00 crores |

| 6. Gross profitability before interest & depreciation | Rs.16.12 crores | Rs.29.25 crores | Rs.48.00 crores |

| 7. Estimated cost of the project | Rs.30.00 crores | Rs.40.00 crores | Rs.60.00 crores |

| 8. Pay-back period (assuming the capacity utilization of 60% during I year, 80% during II year & 100% during III year) | Less than 32 months | Less than 27 months | Less than 25 months |

TECHNOLOGY TRANSFER & TURN-KEY CONSULTANCY ON PARTICLEBOARD PROJECT–

‘GoodRich’ offers these highly profitable MDF board production lines for the Indian entrepreneurs. Our services include technology transfer, design & installation of the Plants from concept to commissioning including Feasibility studies, Plant Engineering, Equipment selection & procurement, Co-ordination in project management, operational training and initial marketing support.

At the time of widespread deforestation & with timber reserves under pressure from the growing worldwide demand for wood & panel products such as plywood, MDF offers low-risk entry into a potentially lucrative market.

For more details, please contact –

|

GoodRich MAGMA Industrial Technologies Limited | |

No. 704, 4th 'A' Cross, HRBR Layout 1st Block, | Kalyan Nagar, Bangalore - 560 043, | | Karnataka, India. | | Ph: 0091 - 80 - 41138200 | Email: [email protected] / | [email protected] | Website: www.goodrichmagma.com / | www.goodrichsugar.com | | |

|

|

|